Introduction

Saving money has never been more important than in today’s rapidly changing financial landscape. While many people live paycheck to paycheck, there is a growing awareness of the importance of building a savings cushion for emergencies, future goals, and GomyFinance.com Saving Money. However, saving can sometimes feel overwhelming, especially when there are so many distractions and financial obligations competing for your attention.

At GomyFinance.com Saving Money, we believe that saving should be simple, effective, and most importantly, accessible to everyone. This blog post is designed to help you understand the importance of saving, learn various strategies, and take practical steps towards a more financially secure future.

1. The Importance of Saving: A Path to Financial Security

Before diving into strategies and tactics, it’s important to grasp why saving money should be one of your top financial priorities. While it might seem tempting to focus on earning more, saving is often the more achievable route to financial stability. Here are a few reasons why saving is critical:

- Emergency Fund: Life is unpredictable, and without an emergency fund, a single unexpected expense could derail your financial plans. Whether it’s a car repair, medical emergency, or sudden job loss, having a financial buffer will keep you afloat.

- Achieving Financial Goals: Whether you’re saving for a house, your children’s education, or a dream vacation, putting money aside regularly makes these goals attainable.

- Reducing Stress: Financial worries are one of the most common causes of stress. Building up your savings can provide peace of mind, knowing that you’re prepared for whatever comes your way.

2. Key Strategies to Save Money: Start Small, Build Big

At GomyFinance.com Saving Money, we advocate for a structured approach to saving. Rather than focusing on saving large amounts of money all at once, it’s often more effective to start with small, consistent savings goals. Here are some strategies to help you build your savings over time:

Automate Your Savings

One of the easiest and most effective ways to save is by automating the process. Set up a direct deposit from your checking account to your savings account. By automating this, you remove the temptation to spend the money before you’ve had a chance to save it. GomyFinance.com Saving Money recommends automating at least 10% of your monthly income into savings as a baseline.

Budgeting with the 50/30/20 Rule

A tried and tested rule in personal finance is the 50/30/20 rule. This budgeting method suggests dividing your after-tax income into three categories:

- 50% for needs: These include essentials like housing, utilities, groceries, and transportation.

- 30% for wants: This category includes entertainment, dining out, travel, and hobbies.

- 20% for savings and debt repayment: This portion should go directly into your savings or be used to pay off debt.

By using this rule, you can easily balance your spending while ensuring that savings are always part of your financial plan.

Use Budgeting Apps to Stay on Track

If you find budgeting tedious, there’s no shortage of apps available to make it easier. Apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you track your expenses, create savings goals, and even send you reminders when you’re getting close to exceeding your budget. GomyFinance.com Saving Money recommends exploring these tools as they simplify the process of managing your finances.

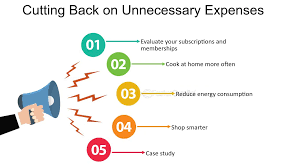

3. Cutting Unnecessary Expenses: Finding Hidden Savings

Most of us have more financial waste than we realize. The good news is that by making small adjustments to your daily spending habits, you can uncover hidden savings without significantly impacting your lifestyle. Here are a few areas to examine:

Review Your Subscriptions

In today’s digital world, it’s easy to accumulate multiple subscription services. From streaming platforms to monthly box subscriptions, these services can quickly add up. Take a close look at all your subscriptions and ask yourself if you’re really using them. Cancelling even a few services can free up money for your savings.

Cook at Home More Often

Dining out can be one of the biggest drains on your budget. By cooking at home, you not only save money but also eat healthier. Planning meals in advance, cooking in bulk, and using grocery store sales are all effective ways to reduce your food costs.

Shop Smarter

Impulse buying is a common reason why many people struggle to save. To combat this, make a habit of sticking to a shopping list and only buying what you need. Additionally, use discount apps, look for sales, and consider buying second-hand items when appropriate.

4. Debt Management: Freeing Up Money for Savings

For many people, debt is a significant barrier to saving. High-interest debts, such as credit card debt, can take up a large portion of your monthly income, leaving little room for savings. Here’s how you can tackle debt effectively to free up more cash for savings:

Pay Off High-Interest Debt First

High-interest debt can snowball quickly if not addressed. Focus on paying off the debt with the highest interest rate first, while making minimum payments on your other debts. This is known as the avalanche method and is one of the fastest ways to become debt-free.

Consider Debt Consolidation

If you have multiple debts with high-interest rates, debt consolidation may be an option. By consolidating your debts into one loan with a lower interest rate, you can reduce your monthly payments and pay off the debt faster.

GomyFinance.com Saving Money suggests reviewing your debt situation and exploring consolidation or refinancing options to lower your financial burden.

5. The Power of Compound Interest: Let Your Money Work for You

One of the most powerful tools in saving is compound interest. Compound interest allows your savings to grow exponentially over time because you earn interest on your interest. The earlier you start saving, the more significant the impact of compound interest will be.

Start with a High-Yield Savings Account

While traditional savings accounts offer minimal interest, many online banks offer high-yield savings accounts with much higher interest rates. This means that your savings will grow faster over time.

Invest in Retirement Accounts

Another great way to leverage compound interest is by investing in retirement accounts like an IRA (Individual Retirement Account) or a 401(k). These accounts not only help you grow your savings through investments but also come with tax benefits.

At GomyFinance.com Saving Money, we encourage you to start saving early to take full advantage of compound interest and maximize your financial growth.

6. Practical Tips for Daily Saving: Small Changes, Big Impact

You don’t need to make drastic changes to your lifestyle to start saving money. Often, small, consistent changes can make a big difference in your long-term savings. Here are a few practical tips that can help you save daily:

Use Cashback and Rewards Programs

Take advantage of cashback programs and rewards credit cards. Many credit cards offer cashback on purchases like groceries, gas, or dining out. By using these cards responsibly and paying them off in full each month, you can save money on your everyday purchases.

Reduce Energy Costs

Energy bills can be a significant expense, but there are many ways to reduce them. Switching to energy-efficient light bulbs, unplugging devices when not in use, and adjusting your thermostat can all help lower your utility costs.

Buy in Bulk

For non-perishable items like paper products, cleaning supplies, or even canned goods, buying in bulk can save you a lot of money over time. Just make sure you have enough storage space and that the items won’t expire before you can use them.

7. Investing: Taking Your Savings to the Next Level

Once you have a solid savings foundation, you can start thinking about investing. Investing allows your money to work for you, growing your wealth over time. Here’s how to get started:

Start Small

If you’re new to investing, don’t be intimidated. You don’t need a lot of money to start. Many apps, like Acorns and Robinhood, allow you to invest small amounts of money in stocks or exchange-traded funds (ETFs).

Diversify Your Investments

To reduce risk, it’s essential to diversify your investments. This means spreading your money across different types of investments, such as stocks, bonds, and real estate. By diversifying, you can protect your portfolio from significant losses if one investment performs poorly.

GomyFinance.com Saving Money offers resources to help you learn more about investing and how to make informed decisions.

8. Avoiding Common Savings Pitfalls

Even with the best intentions, saving money can be challenging. Here are some common savings mistakes and how to avoid them:

Impulse Buying

It’s easy to fall into the trap of impulse buying, especially with online shopping. To avoid this, try using the 24-hour rule: wait 24 hours before making a purchase. Often, you’ll find that the urge to buy has passed, and you can save that money instead.

Neglecting Long-Term Savings

While short-term savings are essential, it’s also crucial to focus on long-term goals like retirement. Make sure you’re contributing regularly to a retirement account to ensure a comfortable future.

Conclusion

Saving money doesn’t have to be overwhelming or complicated. By implementing small, consistent changes and taking advantage of the tools available, you can build a secure financial future. Whether it’s automating your savings, cutting unnecessary expenses, or investing wisely, there are many ways to grow your wealth over time.

GomyFinance.com Saving Money is here to guide you every step of the way. Start today, and take control of your financial future with simple, effective savings strategies. With the right mindset and resources, financial freedom is within your reach.